U.S. board members continue their streak of optimism in January fueled by recovering supply chains, continued consumer spending and healthy unemployment levels. Although many forecast a recession and economic slowdown, they say it will be mild and short-lived, passing through sometime in mid-2023. Most predict that business conditions will improve by this time next year.

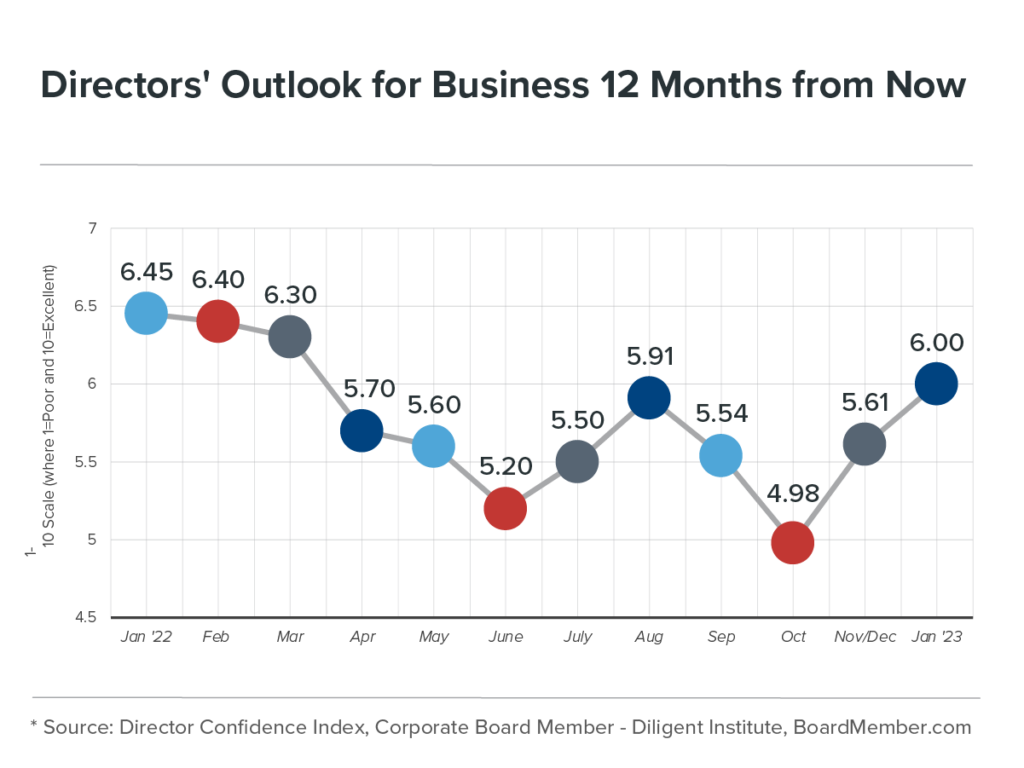

Directors’ forecast of business conditions 12 months from now stands at a 6.0 out of 10, according to the January Director Confidence Index, our monthly sentiment poll conducted in partnership with Diligent Institute. Fielded between January 15-20, the data from responses by 124 U.S. public company board members is a signal that we may be on our way to better business conditions, more stable markets and a stronger economy.

Directors’ rating of current business conditions ticked up 1 percent in January to 5.9 from 5.8 in December, as measured on a 10-point scale where 1 is Poor and 10 is Excellent. This is the second consecutive gain on that measure, following a year of declines in 2022.

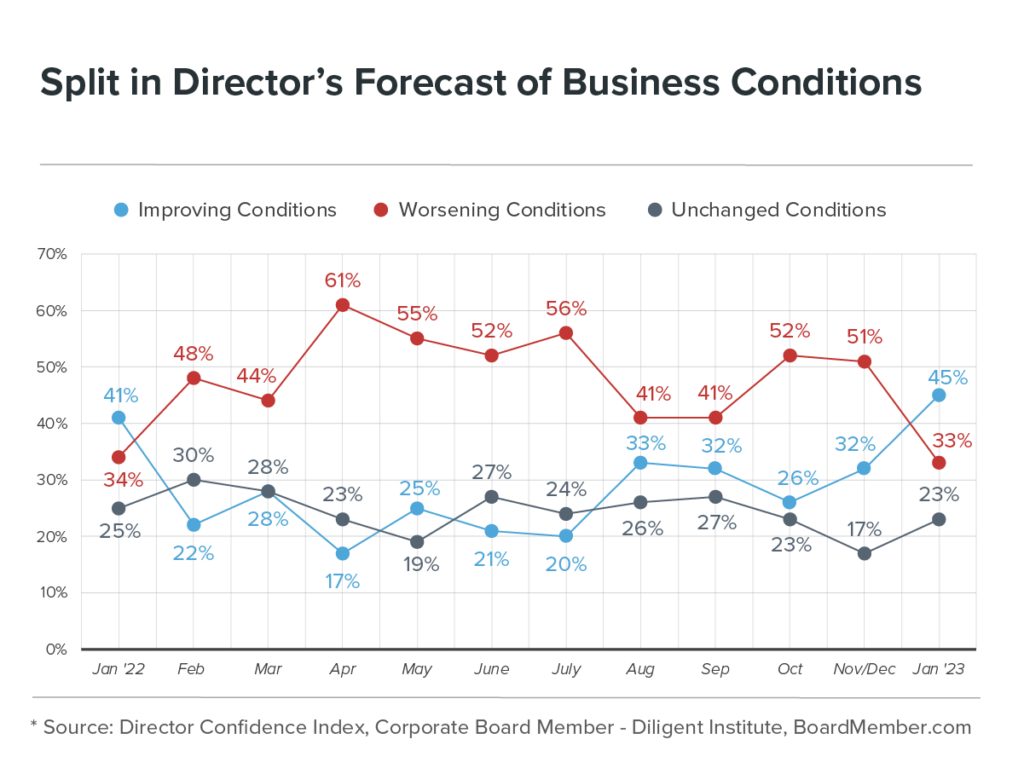

In a turn of events from last month, a higher proportion of directors are now forecasting that business conditions will improve over the course of the next 12 months for the first time since last January. At 45 percent, this is the highest proportion of directors forecasting improvement since we began tracking the measure in June of 2021.

“The current stock market woes are due to uncertainty. Now that the mid-terms are over, the Supreme Court will have weighed in on its slate of cases through the spring into the fall, and the war in Ukraine will have progressed further, businesses can gain firmer footing on the “new normal” – even if the conditions are not perfect, they will be known.” -Barbara A Higgins, Committee Chair, Employers

A. Papoulias, outside director at United Guardian, Inc, a company in consumer discretionary, agrees that conditions will continue to improve, predicting the same 7 out of 10 12 months down the line as Higgins. He forecasts, “There will be a short recession in mid-2023 but labor markets remain resilient. I predict quick recovery by the end of 2023.”

Despite the positive outlook of many, one-third of directors still forecast that business conditions will deteriorate over the next 12 months and 23 percent predict that conditions will remain unchanged.

John Schwarz, board chair at Visier Inc. a tech company, expects conditions to remain weak or a 4 out of 10 rating for some time, at least until this time next year. He explains, “There is still a labor shortage, an ongoing trade war with China, a war in Europe, and the resulting inflation affecting my forecast.”

The year ahead

A whopping 62 percent of directors expect to spend more time discussing financials in the year ahead, compared to 2022. Human capital strategy is the second most popular topic, with 44 percent of directors expecting to spend more time discussing it in board meetings.

Sustainability strategies is the topic that the highest proportion of directors expect to spend less time discussing in board meetings in 2023, at 47 percent. Mergers, divestitures and acquisitions and board/CEO refreshment and succession planning are also at the bottom of the board’s priority list, according to 38 percent of directors.

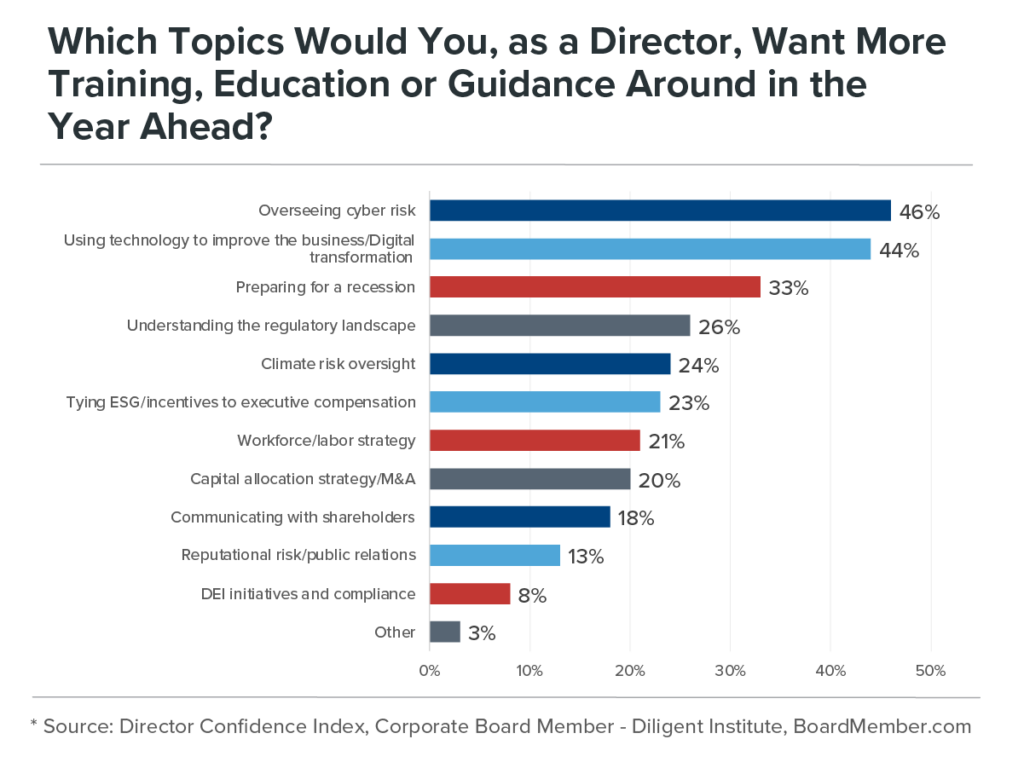

When directors were asked in which topics they want more training, education, or guidance around in the coming year, their top pick was overseeing cyber risk, selected by 46 percent of directors. Following that is using technology to improve the business/digital transformation according to 44 percent of directors. Further behind is the topic of preparing for a recession, in which one-third of directors said they want more training, education, or guidance around.

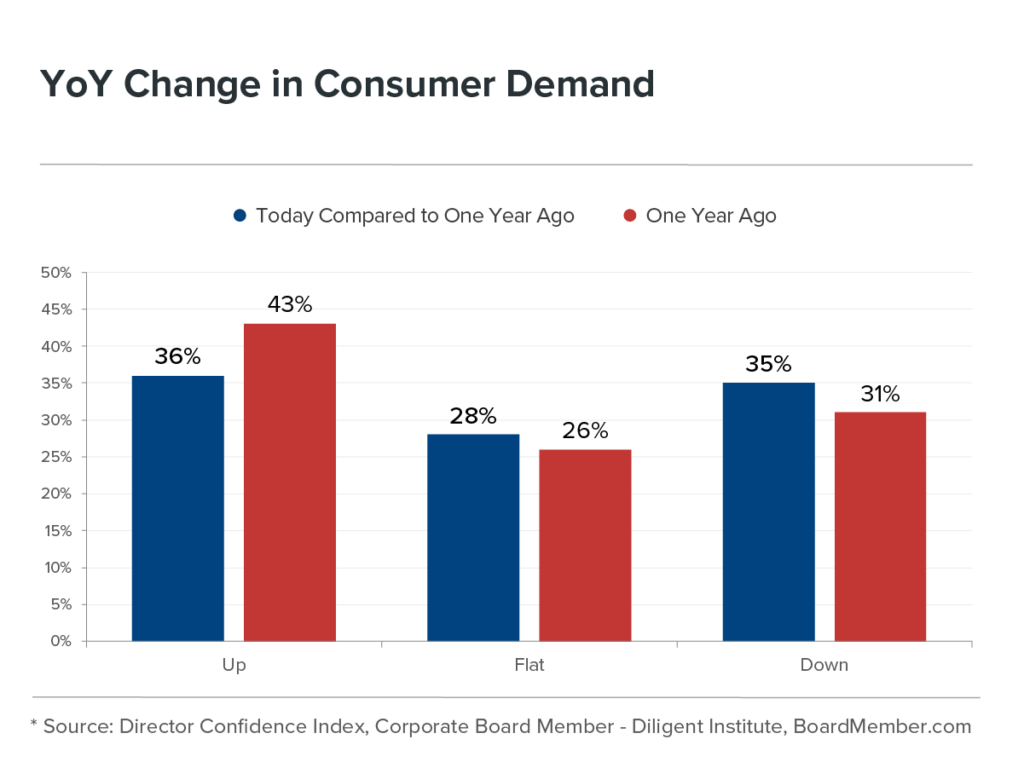

The proportion of directors who say that consumer demand is up since one year ago today dropped in January, from 47 percent in December to only 36 percent now, signaling that consumers may be slowing the pace of their purchases. However, the proportion forecasting that demand will increase one year down the line grew this month, up 5 percent to 43 percent.

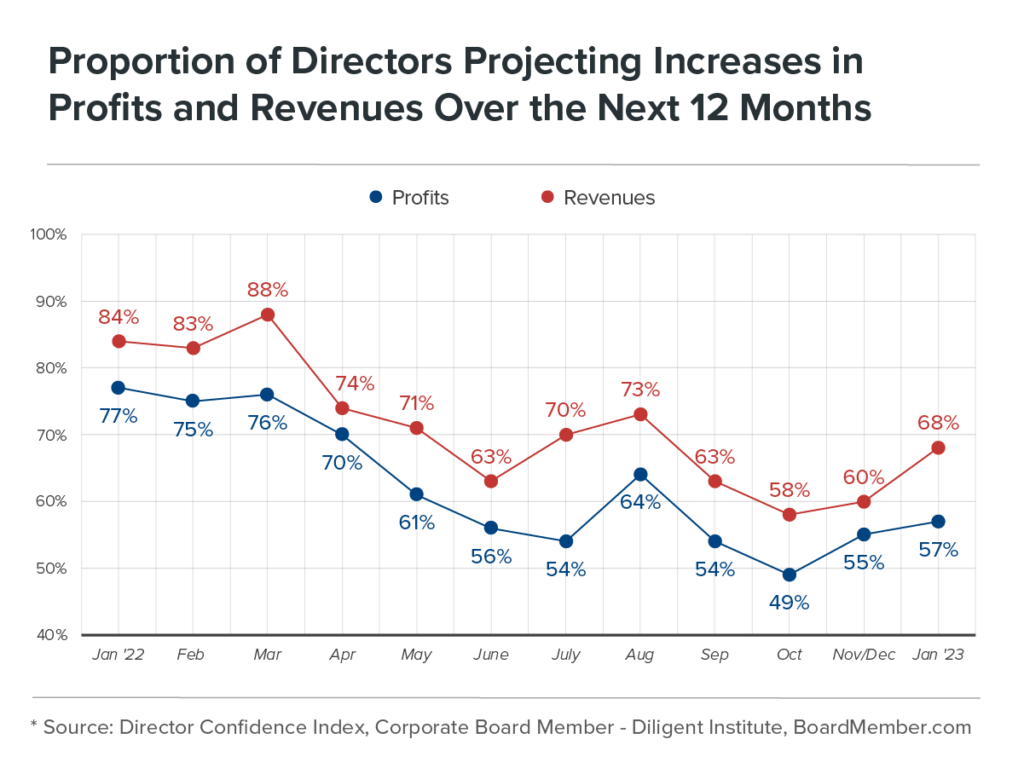

A growing proportion of directors project that revenues will increase over the next 12 months, up 14 percent since December. Now, a whopping 68 percent of directors forecast increasing revenues—closing in on the often more optimistic CEOs of which 70 percent project increasing revenues over 2023.

The proportion of directors forecasting increases in profits ticked up 4 percent in January to 57 percent, the highest proportion since August.

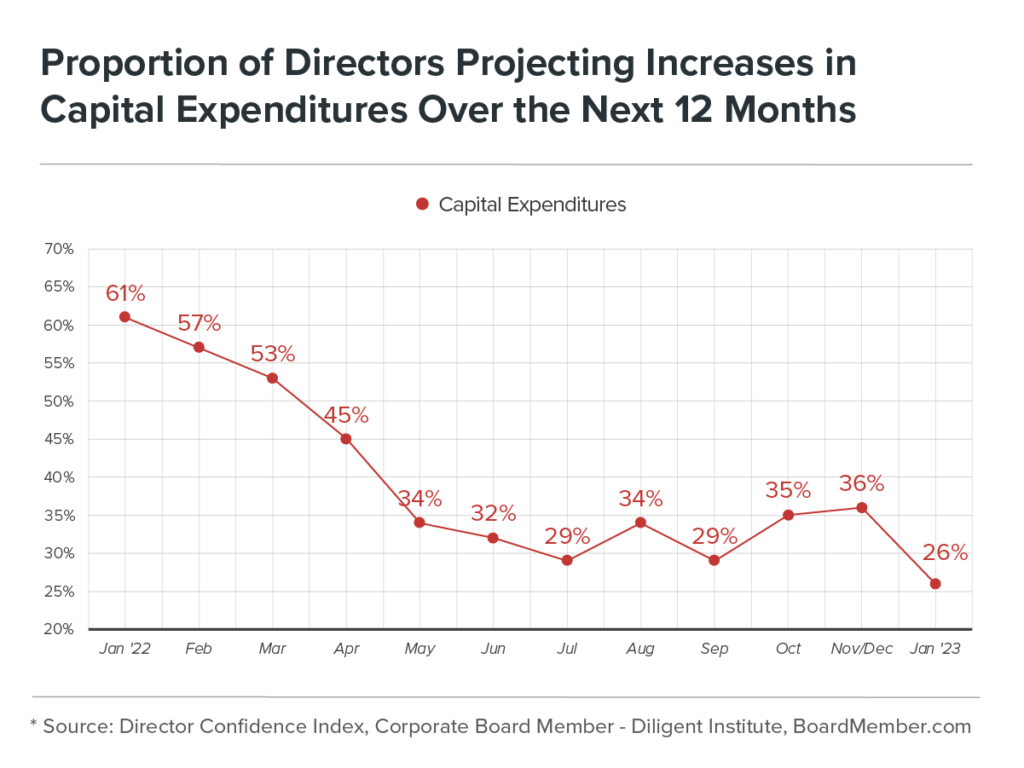

When it comes to capital expenditures, however, far fewer directors expect increases. The proportion of directors who say capex will increase over the next 12 months dropped by 29 percent since last month and now reads 26 percent—the lowest proportion on record.

About the author

Lead Research Specialist

Kira Ciccarelli is the Lead Research Specialist of the Diligent Institute, the modern governance think tank and global research arm of Diligent Corporation. In her role, Kira researches and produces high-level modern governance reports, blog articles and podcasts designed to inform director decision-making and highlight best practices.

Before joining Diligent, Kira worked in a variety of data-driven research roles, including analyzing global aid funds to the UN Sustainable Development Goals (SDGs) and compiling a meta-analysis of political experimental findings for the Analyst Institute. She holds a BA in Public Policy from the College of William & Mary.

Related content

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Inform

State of Cyber Awareness in the Boardroom

NightDragon, Diligent and our coalition of industry leaders analyzed the leadership…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – July 2023

Diligent Institute and Corporate Board Member’s Director Confidence Index for July…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – February 2023

In February, resolving supply chain issues are fueling many directors’ improving…