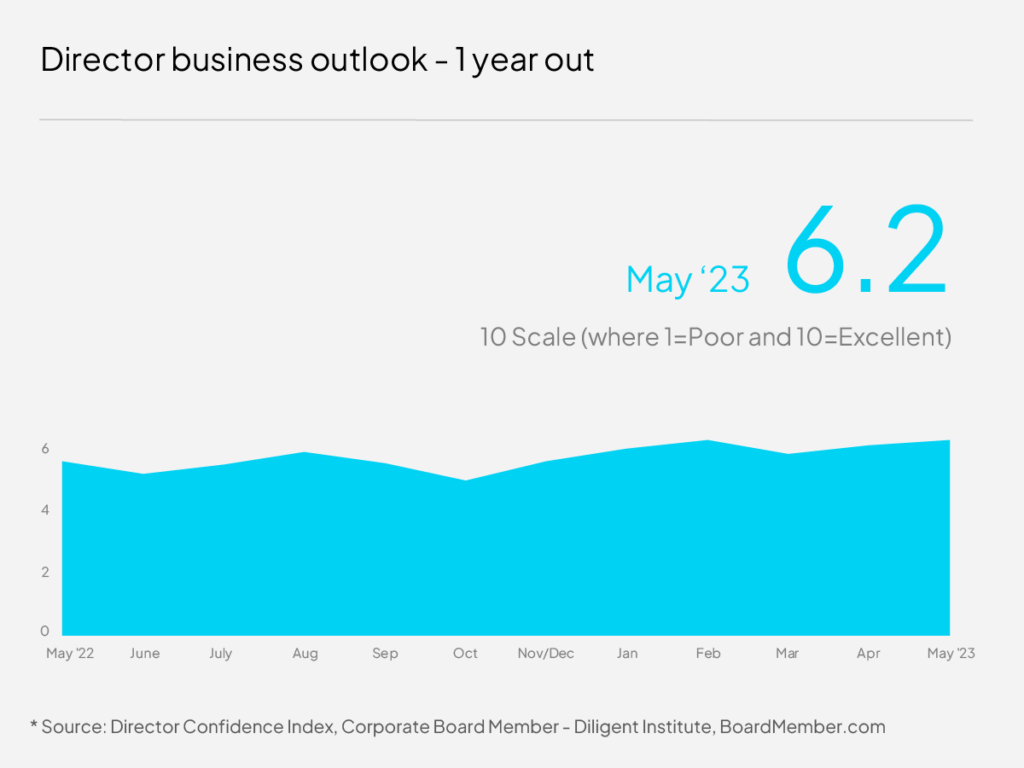

After a sharp decline in March, the Director Confidence Index clawed back nearly all of its remaining losses in May, climbing another 2 percent, to 6.2.

That’s a second consecutive uptick in optimism, after a 5 percent jump in April. At its current level, the forward-looking indicator—based on a monthly survey of U.S. public company board members conducted in partnership with the Diligent Institute—is almost fully in line with its February level (6.3), the highest point it has reached over the past 12 months.

Confidence in current business conditions is also up 3 percent, to 6.3, from 5.1 in April. That is the highest level the index has been in over 12 months, since April 2022 (6.6).

While a level of 6.2 is within “Good” territory, according to the 10-point scale, it is still not far from “Weak” (between 4 and 6 on the scale) and remains well below the levels recorded at this time in 2021. Directors say they expect that a year from now, the Fed will have tackled inflation and stopped raising rates—both positives for business—but not without causing a spike in unemployment, slowing demand and raising questions over the future of many banks. All of this, of course, going into an election year.

Ana Dutra, who serves on the boards of Carparts, Amyris and Pembina Pipeline, says the political, economic and social instability is driving her 12-month forecast of 3 out of 10 (down from a 6 today). “The upcoming elections, inflation, recession, global supply chain issues,” she says, are all adding to the gloomy outlook.

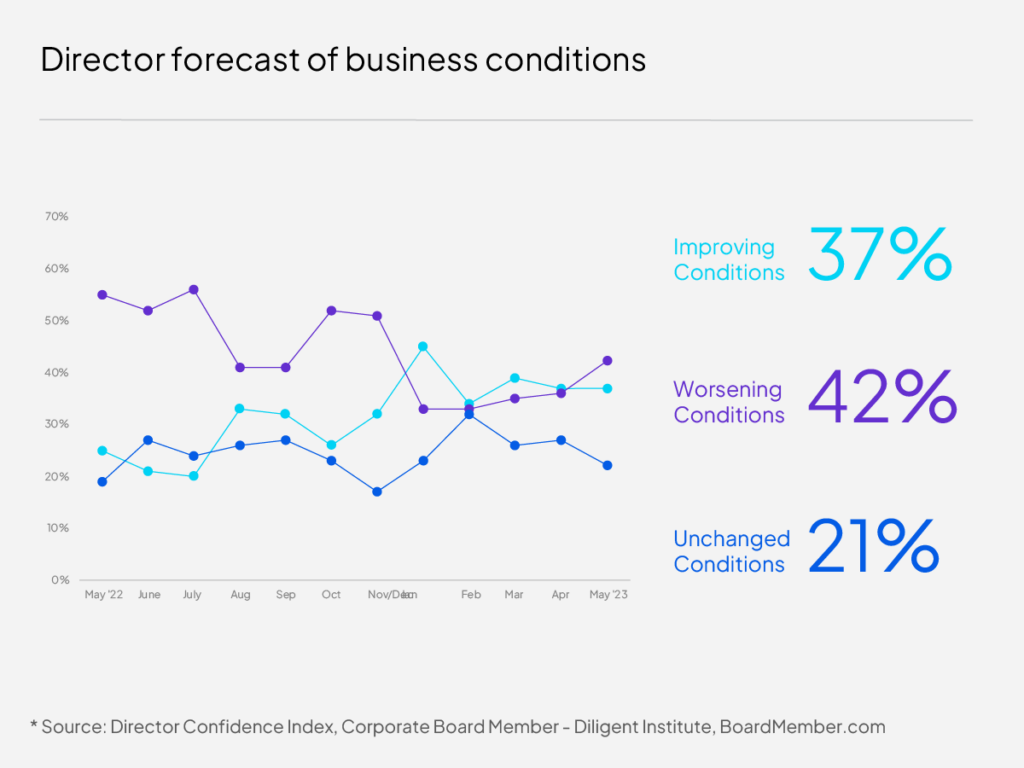

And she’s not alone. Despite the improved forecast overall, 42 percent of the 140 directors surveyed said they expect conditions to deteriorate over the next 12 months, up from 36 percent in April. Many say a recession is now unavoidable—with several saying we’ve already crossed into that territory.

The year ahead

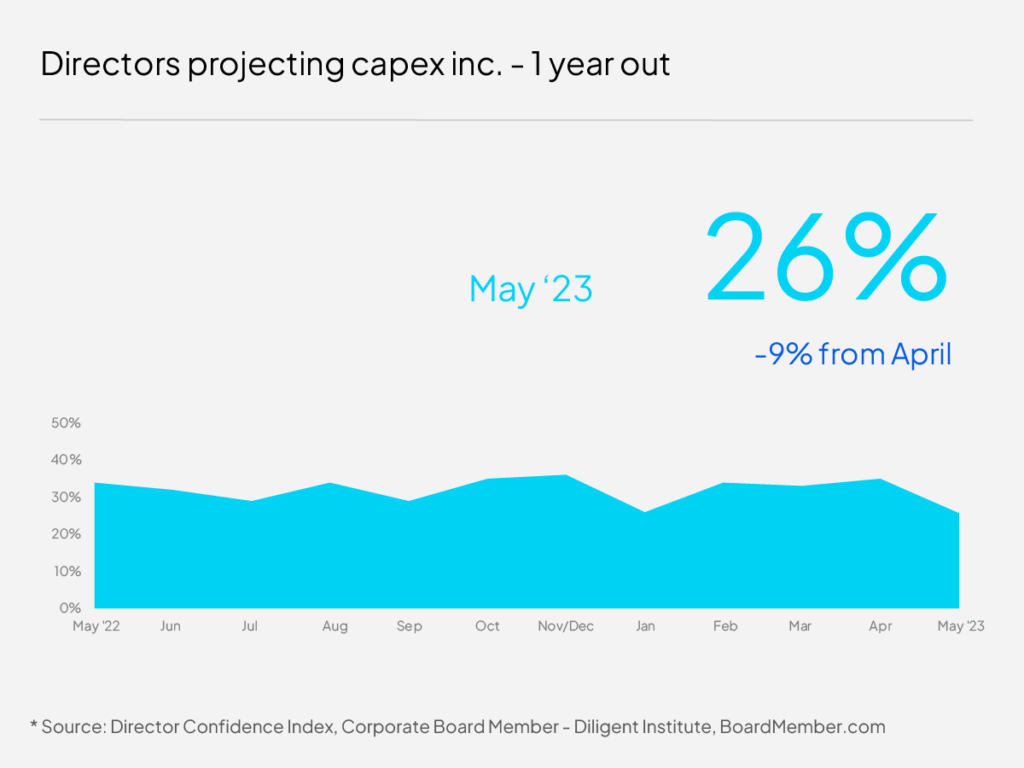

When asked to forecast their own organization’s performance in the 12 months ahead, directors also expect slower growth. Perhaps unsurprisingly with a recession on the horizon, the proportion of directors who expect their organization to increase capital expenditures in the months ahead dropped to 26 percent in May, from 35 percent in April.

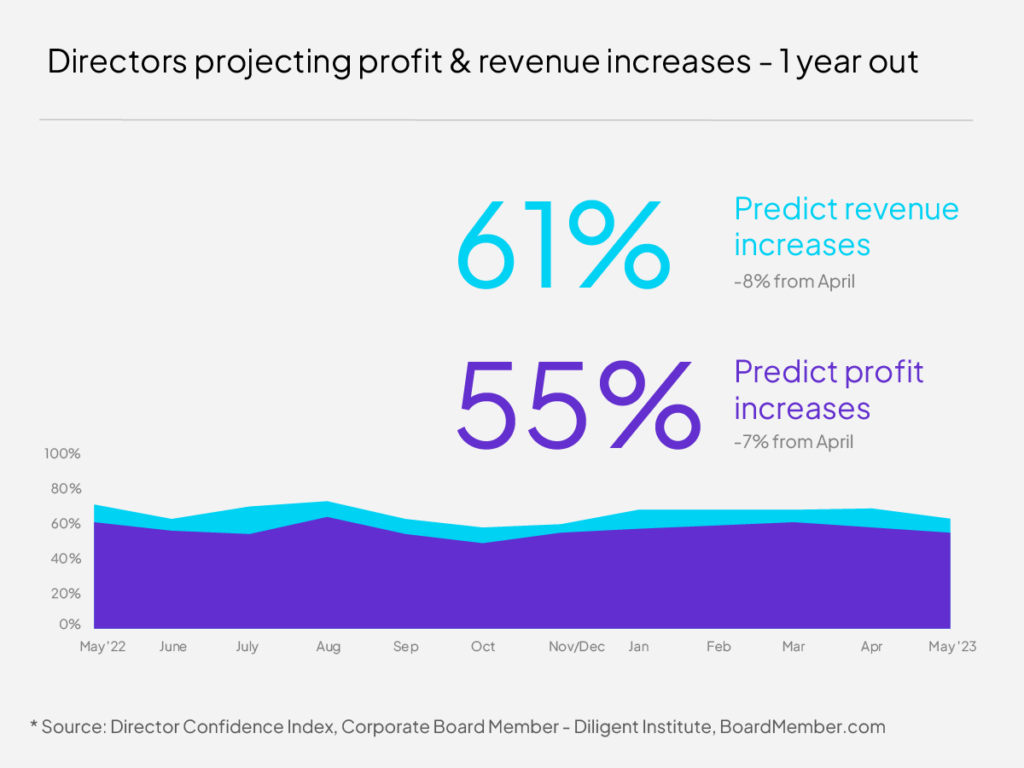

Similarly, the proportion of directors who forecast revenues and profits to increase ticked down, to 60 and 55 percent respectively—from 69 and 62 the month prior. That’s not to say they expect revenues and profits to decline; instead, a growing proportion say they expect flat growth (16 and 21 percent, respectively, from 9 and 16 percent in April).

Boards & AI governance

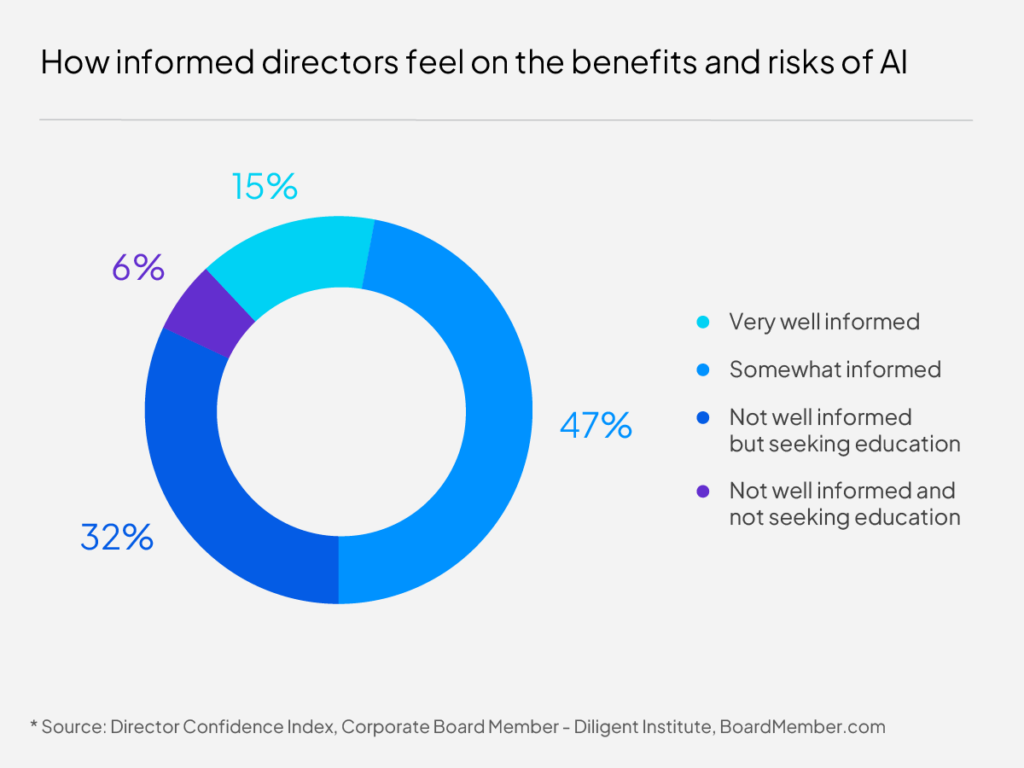

While three-quarters of U.S. public companies are already integrating AI technology into their operations, only 15 percent of board members we polled said they understood the benefits and risks of doing so. AI carries great potential for business—and science—but it also comes with risk. There’s been mounting discussions from governments and experts around the world about the technology’s safety and the need for regulation.

But none of that appears to be stopping public companies from adopting the technology—not even board members saying they do not feel as well informed as they should be to provide oversight on the matter.

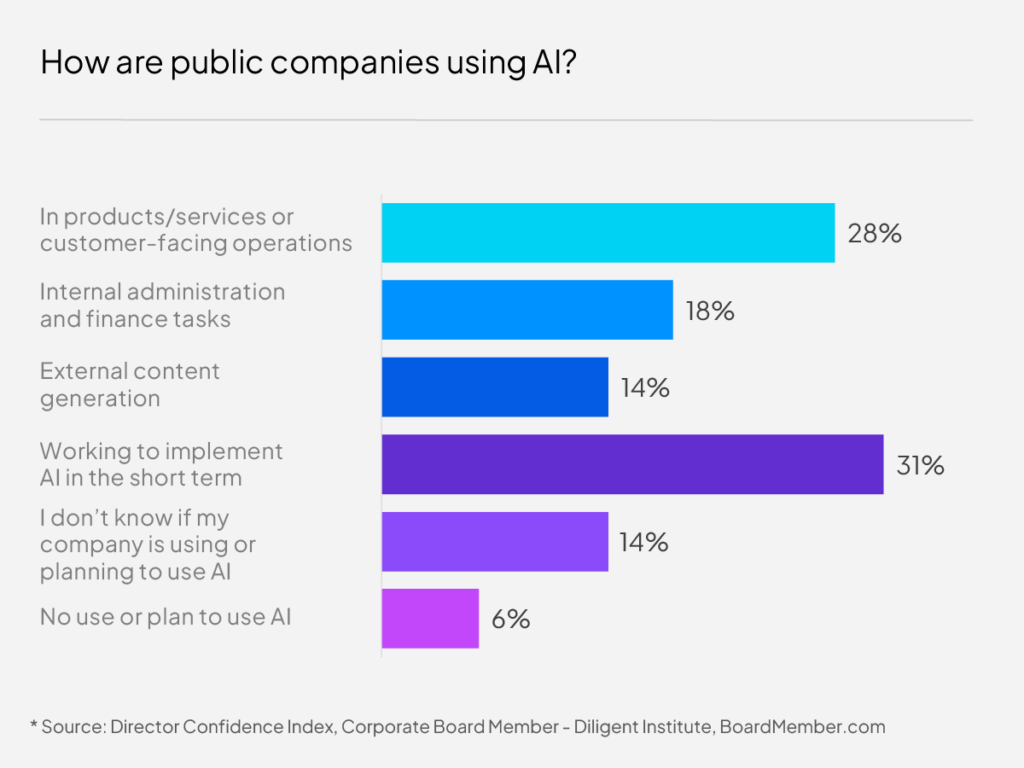

Nearly half (44 percent) of the 140 U.S. public company directors said their companies were already using AI in some capacity, and another 32 percent said that they were working to do so in the short term. Only 6 percent said they had no plans to use AI whatsoever—at least for now—and 14 percent said they didn’t know if their company was using or planning to use AI.

Yet, only 15 percent of the directors participating in the survey said they felt well-informed about the benefits and risks of using AI.

Half of the directors polled said their board was increasingly discussing the issue, and 31 percent said the use of AI had driven them to also independently seek education on the matter. Others, however, felt it was still too early in the AI cycle to focus board time on the matter, and that as AI’s influence, use and liability evolves, “board education will move along with to ensure appropriate use and application,” said one respondent.

Directors are in a unique position to help their companies mitigate the risks of new technologies by asking management teams smart questions. We recently published a great conversation between CBM’s editor-in-chief, Dan Bigman, and Tom Davenport, a professor at Babson University and the author of All In on AI, in which Davenport offers a fascinating framework for directors looking to process and harness all this change and successfully evaluate its use. You can read it here. Diligent Institute has also been working fast to respond to the uptick in pressure on directors to get better informed on AI and other sources of cyber risk and opportunity through the Cyber Risk & Strategy Certification. The program explores emerging tech along with other cyber risk oversight issues that directors are feeling pressured to embrace.

“Directors have a lot on their plate, and many of them might see AI as just one more area of risk they have to tackle—and they might not feel well-versed enough in technology risk in general to feel competent providing adequate oversight. But considering the far-reaching implications of the technology, directors would be well advised to get up-to-speed fast and not ignore what is likely to be the most disruptive technology of our lifetimes.” – Dottie Schindlinger, Executive Director, Diligent Institute

How companies are using AI

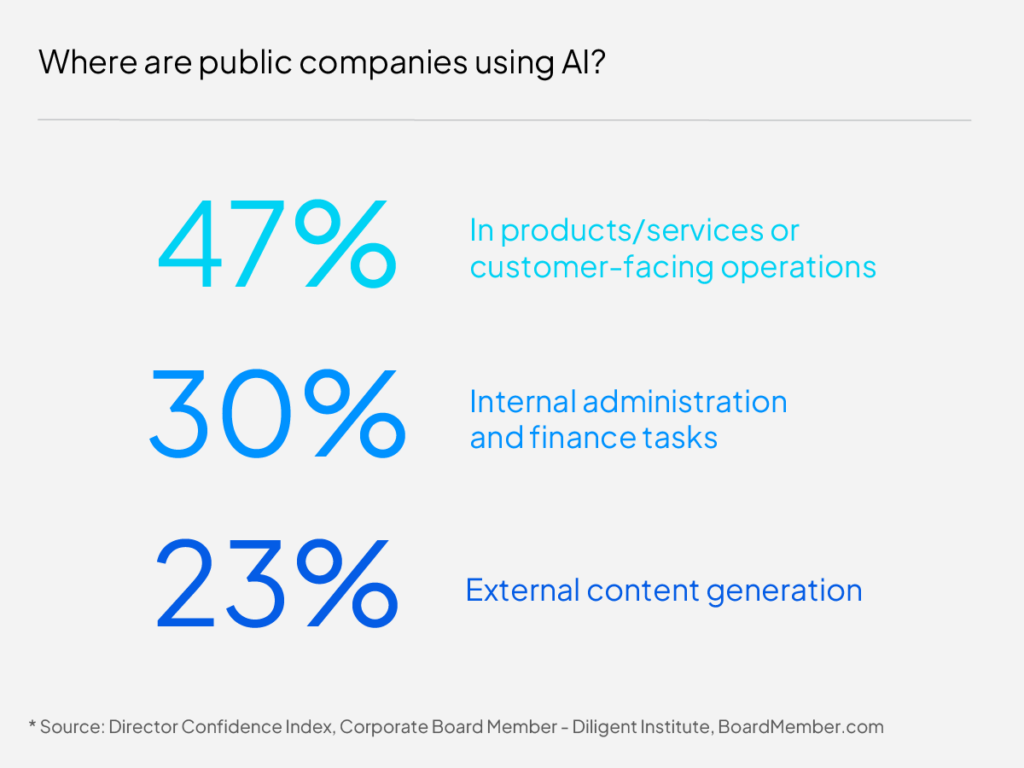

Among those directors who said their companies are already using AI, 47 percent said they did so in customer-facing operations, and 23 percent said for external content generation.

“This aligns to what we’ve been hearing anecdotally—companies have long been adopting technology like chatbots for customer-facing operations,” says Schindlinger. “And solutions like ChatGPT are a very natural fit for content generation—that is, as long as teams responsible do a careful job of supervising and vetting AI-generated content. The key is understanding and mastering emerging technology—and using it to your advantage.”

A deeper look into the data finds different sectors utilizing AI in different ways. For instance, companies in the IT and Consumer Discretionary sectors are making use of the technology primarily in their customer-facing operations (50 and 43 percent, respectively), while Energy directors primarily responded that their use of AI revolved around administrative and finance tasks (44 percent).

As for external content generation, we found a greater number of Healthcare directors selecting that option (20 percent) than in any other sector—though the most common use of AI in that sector remains customer-facing operations (35 percent).

AI use cases in the boardroom

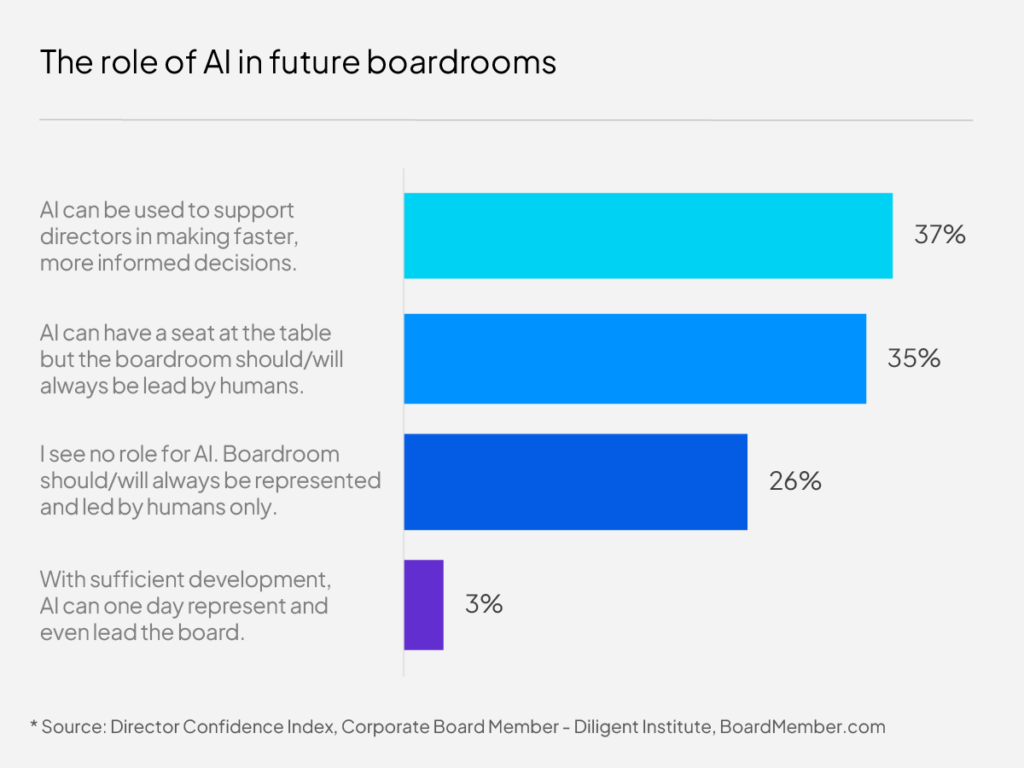

If a good proportion of companies are already tapping into AI’s capabilities, fewer are seeing the value of the technology in the governance process. Thirty-seven percent of directors said AI can be used to support directors in making faster, more informed decisions, but the same proportion said that while AI can have a seat at the table, the boardroom should/will always be led by humans. More than a quarter (26 percent) said they see no role for AI in corporate governance at all.

When asked how AI can best benefit the board specifically, 75 percent said at the audit committee level. How, however, remains to be discussed. AI-powered audit processes can be a game-changer for boards, but they would also be a big liability if not properly checked by humans.

About the author

Lead Research Specialist

Kira Ciccarelli is the Lead Research Specialist of the Diligent Institute, the modern governance think tank and global research arm of Diligent Corporation. In her role, Kira researches and produces high-level modern governance reports, blog articles and podcasts designed to inform director decision-making and highlight best practices.

Before joining Diligent, Kira worked in a variety of data-driven research roles, including analyzing global aid funds to the UN Sustainable Development Goals (SDGs) and compiling a meta-analysis of political experimental findings for the Analyst Institute. She holds a BA in Public Policy from the College of William & Mary.

Related content

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Certifications

AI Ethics & Board Oversight Certification

Learn how to govern AI ethics responsibly in Diligent Institute’s AI Ethics & Board…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – June 2023

Our June poll of public company board members finds a healthy business environment in the…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Certifications

Cyber Risk & Strategy Certification

Get certified to oversee cyber risk & strategy with Diligent Institute, the leading…