June poll of public company board members finds a healthy business environment in the U.S.—one that directors say they expect will remain resilient in the face of a potential recession.

If you had asked public company board members a year ago what they were expecting business conditions to look like by the summer of 2023, very few would have painted a bright picture.

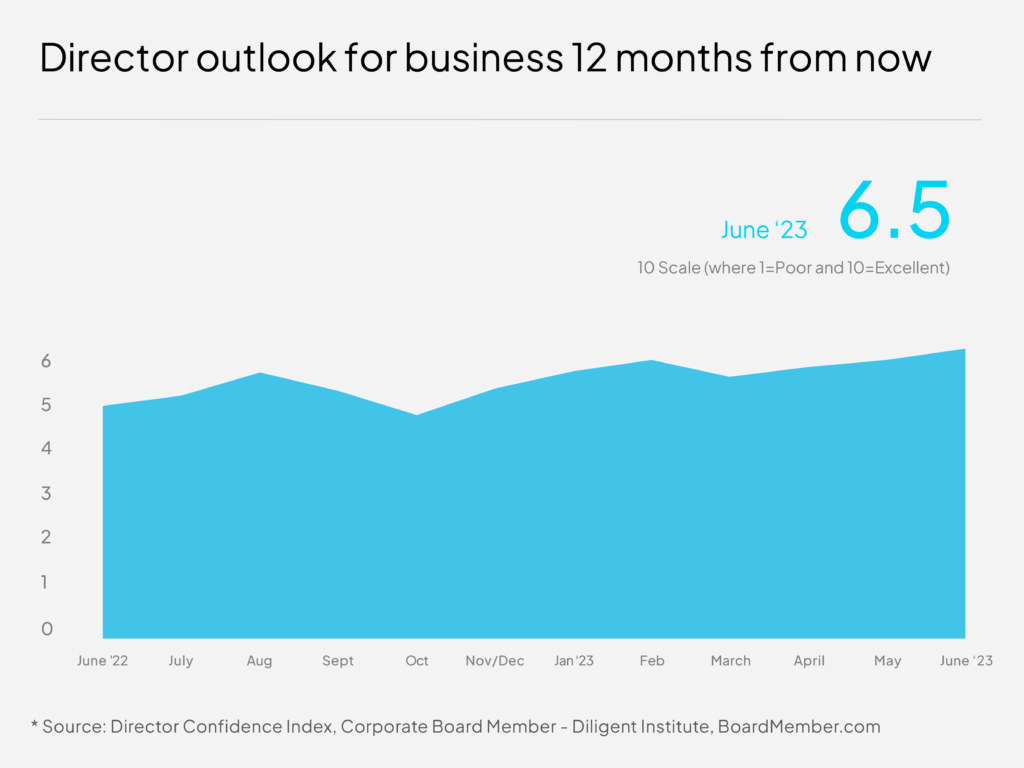

In fact, when we did ask them, in June 2022, to forecast business conditions for June 2023, the 185 directors we polled said they expected them to be at 5.2 out of 10 (on a scale where 10 is Excellent and 1 is Poor)—barely out of “Weak” territory according to our scale. But when we polled directors earlier this week to get their actual assessment of how conditions had fared, things were looking much better: the 132 board members polled June 20-21 said they found current business conditions to rank at 6.4 out of 10—22 percent better than what had been predicted last year. And when we asked them to forecast conditions for next year, by June 2024, they said they expected business conditions to be at 6.5—not a significant increase from where we are today, but an improvement nonetheless.

So, what happened? Directors’ optimism for the business environment in the U.S. has been on the rise for three consecutive months, according to our monthly survey of U.S. public company board members conducted in partnership with the Diligent Institute. At 6.5, the leading indicator is up another 4 percent since May on the back of what polled board members say is slowing inflation, improved supply chains and a persistently confident U.S. consumer in spite of everything, including the threat of a recession (more on that below). It is the highest level it’s been since August 2021—and 11 percent higher than where it was in March, at the time of the bank crisis.

“Inflation will be under control. Interest rates will stop increasing. The housing market for first-time buyers and second homes will grow. And the consumer will start spending again,” summed up Adam Crescenzi, founder of Simply Tuscan Imports and a member of the board of Clough Global Opportunities Fund.

A caveat

It’s important to note that the improving outlook for the year ahead doesn’t necessarily mean directors expect conditions to, ironically, improve. In fact, the proportion of directors who forecast an improvement in business conditions by this time next year stayed relatively flat in June (38 percent vs. 37 percent in May).

What we’re observing is the change in the proportion of those forecasting deteriorating conditions. That number declined 10 percentage points in June, to 32 percent (vs. 42 percent in May). Instead, 31 percent now expect more of a status quo (from 41 percent in May).

The main reason for this change of heart is that 54 percent of the directors polled now believe that while a recession may still happen in the U.S. this year, they expect it to be mild and short-lived. The Fed’s pause—even if temporary—the slowing of inflation, a healthy U.S. consumer and the resilience of businesses are the reasons directors expect a soft landing.

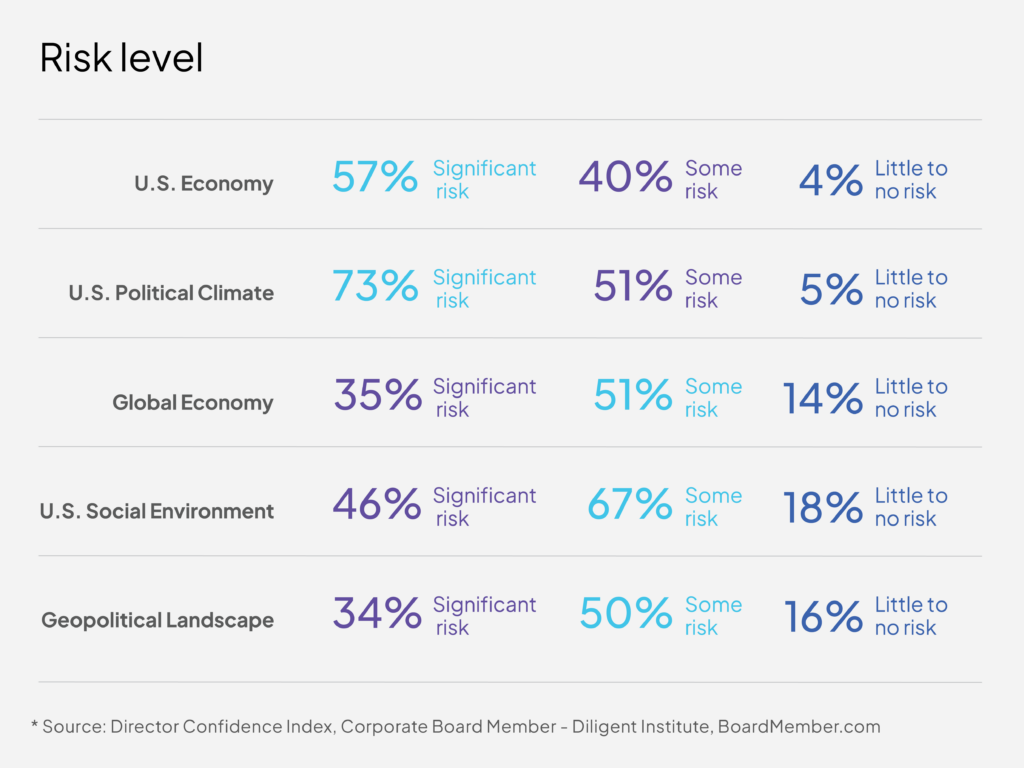

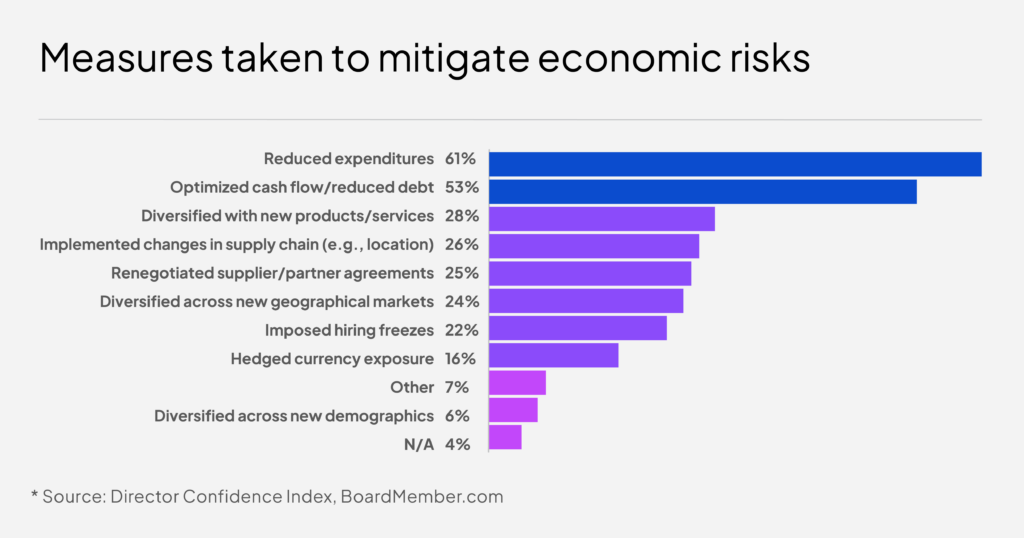

Still, there is caution. Forty percent said the current regulatory environment was significantly affecting their company’s growth and operations, and 57 percent say the near-term trajectory of the U.S. economy continues to represent a significant risk to them. To mitigate that risk, nearly two-thirds of those polled said their companies had reduced expenditures, and 53 percent said they had optimized their cash flow and reduced debt.

The year ahead

With growing optimism, our survey shows an uptick in the proportion of directors who say they expect their companies’ revenues and profits to increase over the next 12 months, at 60 and 65 percent respectively (up from 55 and 60 percent in May). While positive news, those numbers are still trailing their earlier spring highs, when they reached 62 and 69 percent in April.

And despite the fact that 61 percent said their company had reduced their expenditures to help mitigate the economic risk, the proportion of directors who said their companies plan to increase capital expenditures in the next 12 months rose to 33 percent in June, from 26 percent the month prior—just shy of the April high of 35 percent.

About the author

Lead Research Specialist

Kira Ciccarelli is the Lead Research Specialist of the Diligent Institute, the modern governance think tank and global research arm of Diligent Corporation. In her role, Kira researches and produces high-level modern governance reports, blog articles and podcasts designed to inform director decision-making and highlight best practices.

Before joining Diligent, Kira worked in a variety of data-driven research roles, including analyzing global aid funds to the UN Sustainable Development Goals (SDGs) and compiling a meta-analysis of political experimental findings for the Analyst Institute. She holds a BA in Public Policy from the College of William & Mary.

Related content

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Inform

State of Cyber Awareness in the Boardroom

NightDragon, Diligent and our coalition of industry leaders analyzed the leadership…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – July 2023

Diligent Institute and Corporate Board Member’s Director Confidence Index for July…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – May 2023

After a sharp decline in March, the Director Confidence Index clawed back nearly all of…