Director Confidence Index – February 2024

March 1, 2024

Kira Ciccarelli

Topics:

Director Outlook Remains Upbeat in February

Director projections for profit and revenue growth reached multi-year highs this month, but directors remain split in their predictions for where the economy is headed.

Despite some sticky inflation numbers and a contentious election cycle brewing, the business outlook of corporate directors is now more optimistic than it was for nearly all of last year our most recent survey finds, with a growing number of those polled saying they expect the economy will remain at least as good as it is now or improve in the year to come.

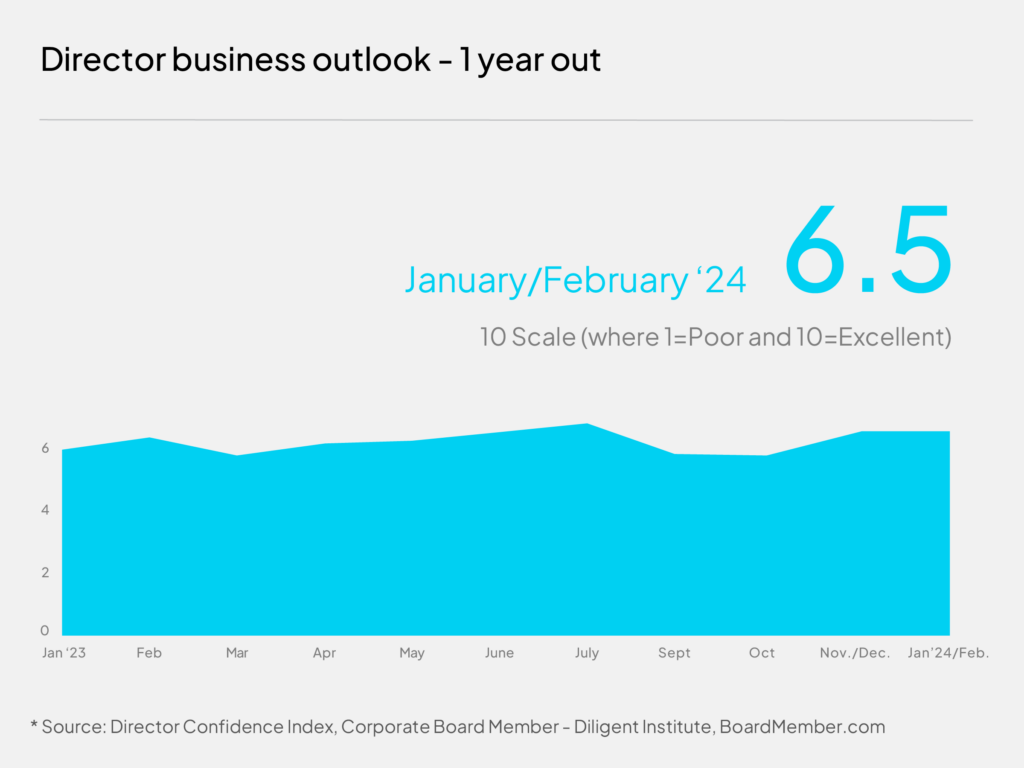

After a double-digit climb in December, the Director Confidence Index—a bi-monthly poll by Corporate Board Member conducted in partnership with Diligent Institute, which measures directors’ outlook for business conditions 12 months from now—stayed at a rating of 6.5 out of 10 this month.

It is similar to the outlook for CEOs we’ve polled though sister publication Chief Executive. Among CEOs we polled in February, their outlook stands at 6.6 out of 10, and both groups pin their forecasts on anticipated rate cuts, moderate GDP growth and resilient consumers. Many directors are also encouraged by the fact that a year down the line, the election will be over.

Directors’ rating of current business conditions is up slightly this month, to 6.5 out of 10, on a 10-point scale where 10=excellent and 1=poor. Their rating of current conditions is a tick better than that of CEOs, who only gave current conditions a 6.3 out of 10.

But under that headline number, divisions remain about where board members think the country is headed, though the vast majority except the economy will remain as it is or improve. In our last poll of directors in December, they were split into even thirds about the direction of the economy—with 33 percent each projecting worsening economic conditions, improving conditions or no change. This month, the proportion of directors predicting improving conditions grew marginally — to 36 percent — ticking past those predicting worsening conditions (28 percent). The remainder —another 36 percent — predict the economy will remain as it is. Each group has conviction—and a rationale—for their views.

“I expect lower rates and more consumer confidence by next year,” says Chris Harned, outside director at Lakeview Farms. He’s one of the directors who expect conditions to improve by this time next year.

Brian Birk, committee chair at Exagen rates both current and future business conditions at 9 out of 10. “We have nothing to fear but fear itself. The numbers are very good across the board,” he says. “Why do people feel so scared about the economy?”

Many of the directors who expect conditions to remain the same or improve point to positive signs in the economy, such as low unemployment, solid consumer sentiment, a strong stock market and persistent economic growth (albeit moderate) and expect those trends to continue. While the 28 percent of directors who forecast worsening conditions expect those trends to soon evaporate, especially as consumer debt grows.

“Continued inflationary pressures leading to higher for longer interest rates; pressure on municipal revenues due to lower assessments on commercial real estate; increasing consumer credit defaults; uncertain political and regulatory environment,” lists the outside director of a large financials company as reasons why he expects conditions to deteriorate.

Others simply believe that a potential soft landing is unlikely, given how rare it has been throughout history. “Since 1955 the Fed has raised rates more than two times in a cycle about ten times,” another director reminds. “Only two times has it resulted in a soft landing. Employment is weakening and consumer credit card and auto debt delinquencies are over 8%, now. There is still economic risk, aside from US election risks and geopolitical risk. We could get lucky, but…”

Many others mention anxiety around the election and the results as well to explain their deteriorating forecast and hesitant optimism.

The year ahead

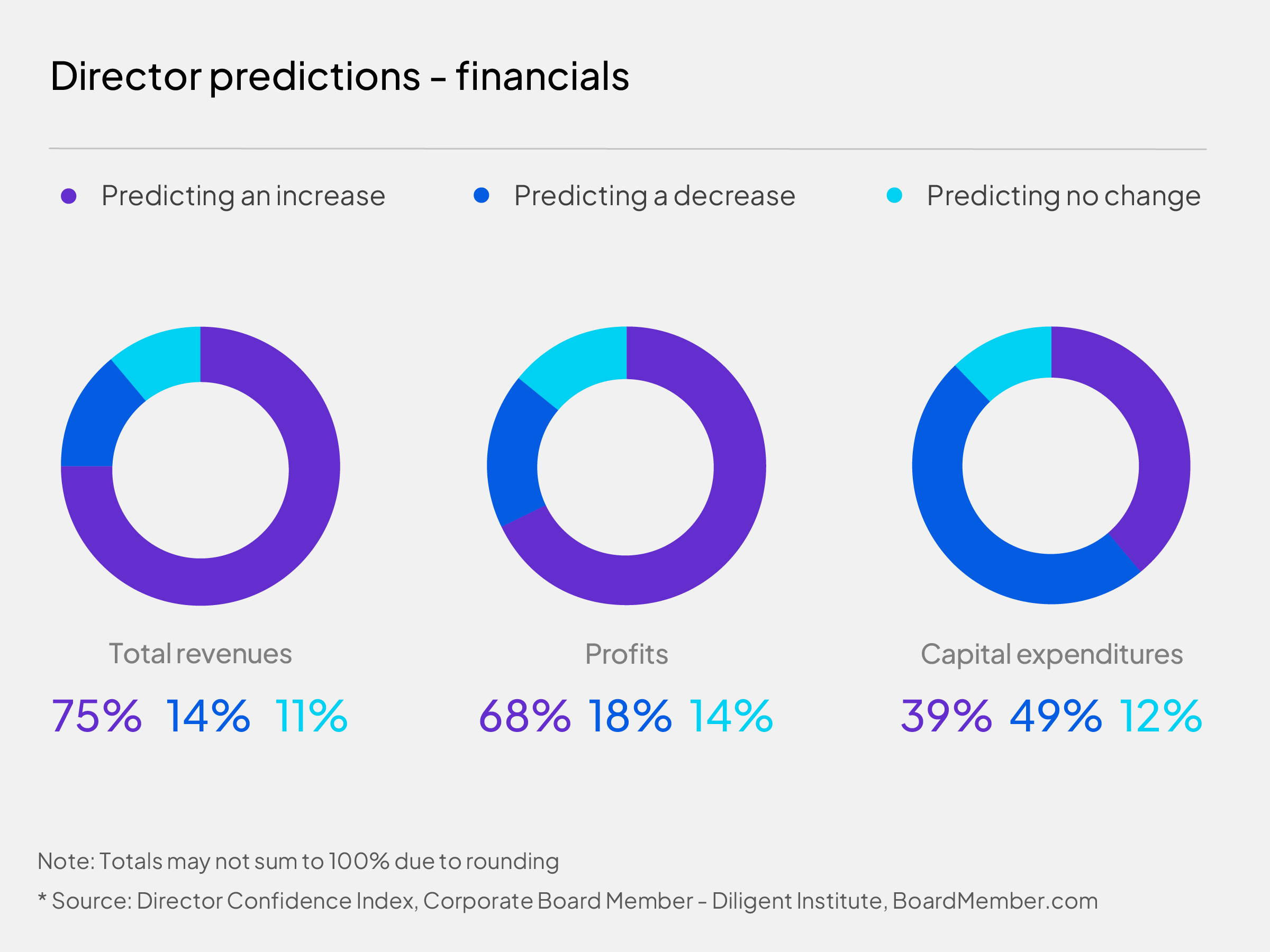

Projections for profit growth over the next 12 months improved in February. The proportion forecasting an increase in profit ticked up 3 percent to 68 percent. That’s slightly higher than the 65 percent of CEOs who project the same, according to Chief Executive’s latest polling, but the highest proportion of directors forecasting profit growth since 2022.

The proportion of directors who forecast increases in revenue climbed 11 percent in February to 76 percent—also the highest proportion projecting revenue growth since March of 2022.

Most directors project either no change or decreasing capital expenditures in 2024—at 60 percent—with 40 percent projecting increases during that time. The proportion has not reached this level since April of 2022. Meanwhile, 45 percent of CEOs are planning to increase capex in the 12 months ahead—down from 49 percent last month.

Cybersecurity and board oversight

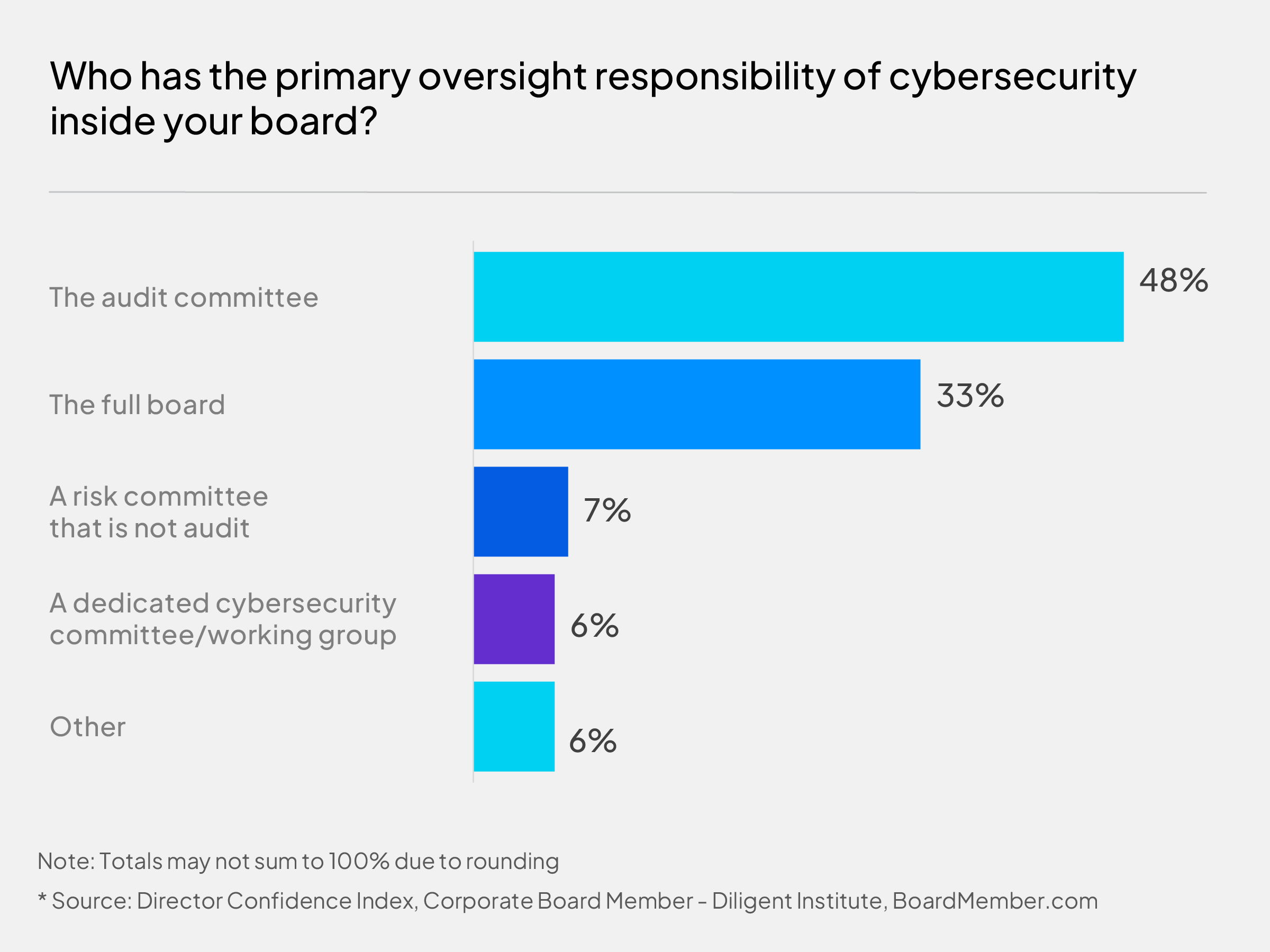

With the growing significance of cybersecurity risk and strategy in today’s business environment, companies are formalizing cyber oversight in their committee structures. Our poll this month reveals that nearly half respondents (48%) delegate cybersecurity oversight to their audit committee. Additionally, a significant portion (33%) say their full board holds primary responsibility for cybersecurity oversight. Meanwhile, only 6% of respondents reported having a dedicated cybersecurity committee.

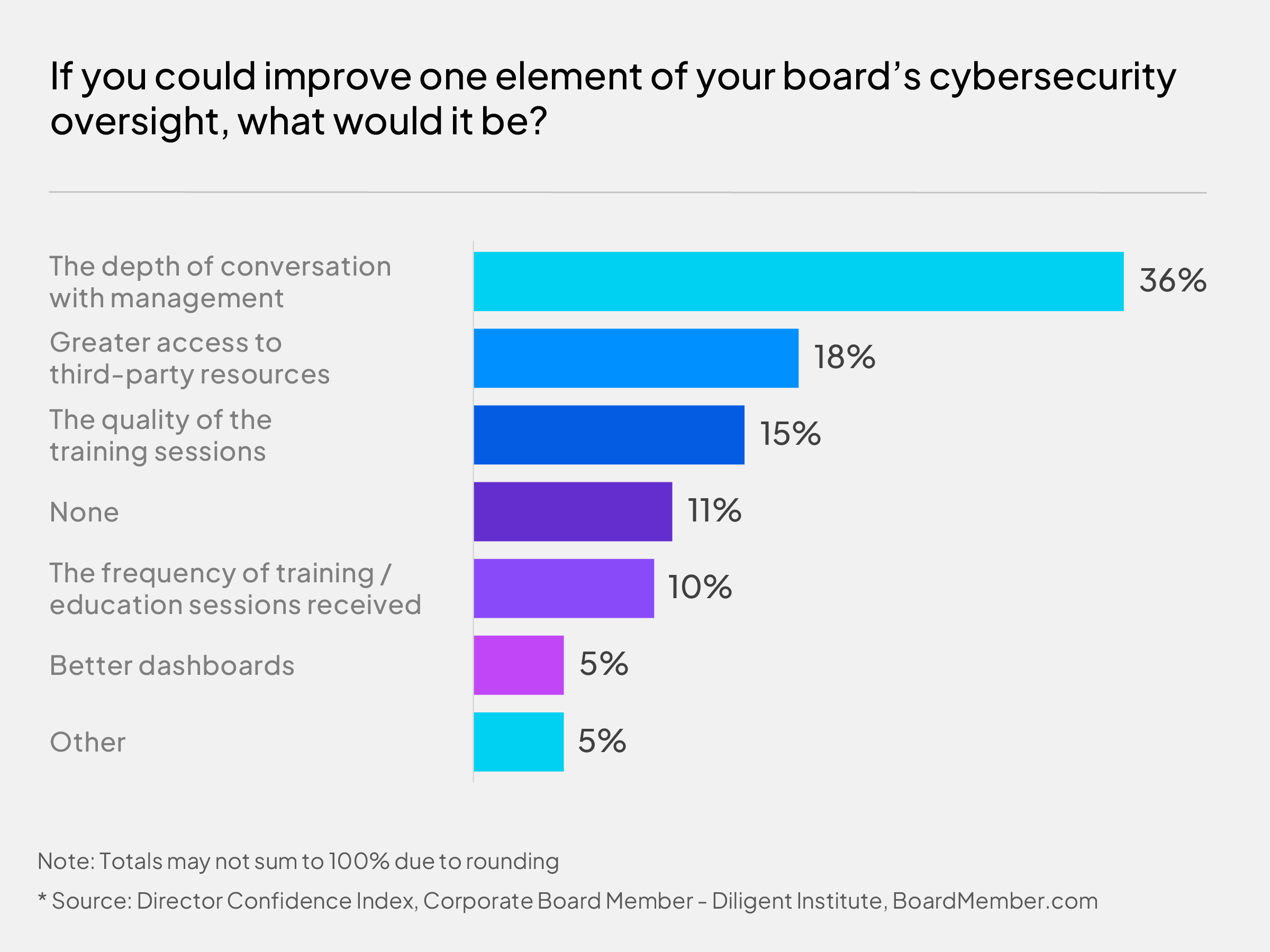

Our responses also highlight the necessity for more in-depth discussions between management and the board regarding the clarity of cyber strategy and metrics. When asked what aspect of the board’s cybersecurity oversight they would most want to improve, 36% of directors cite this.

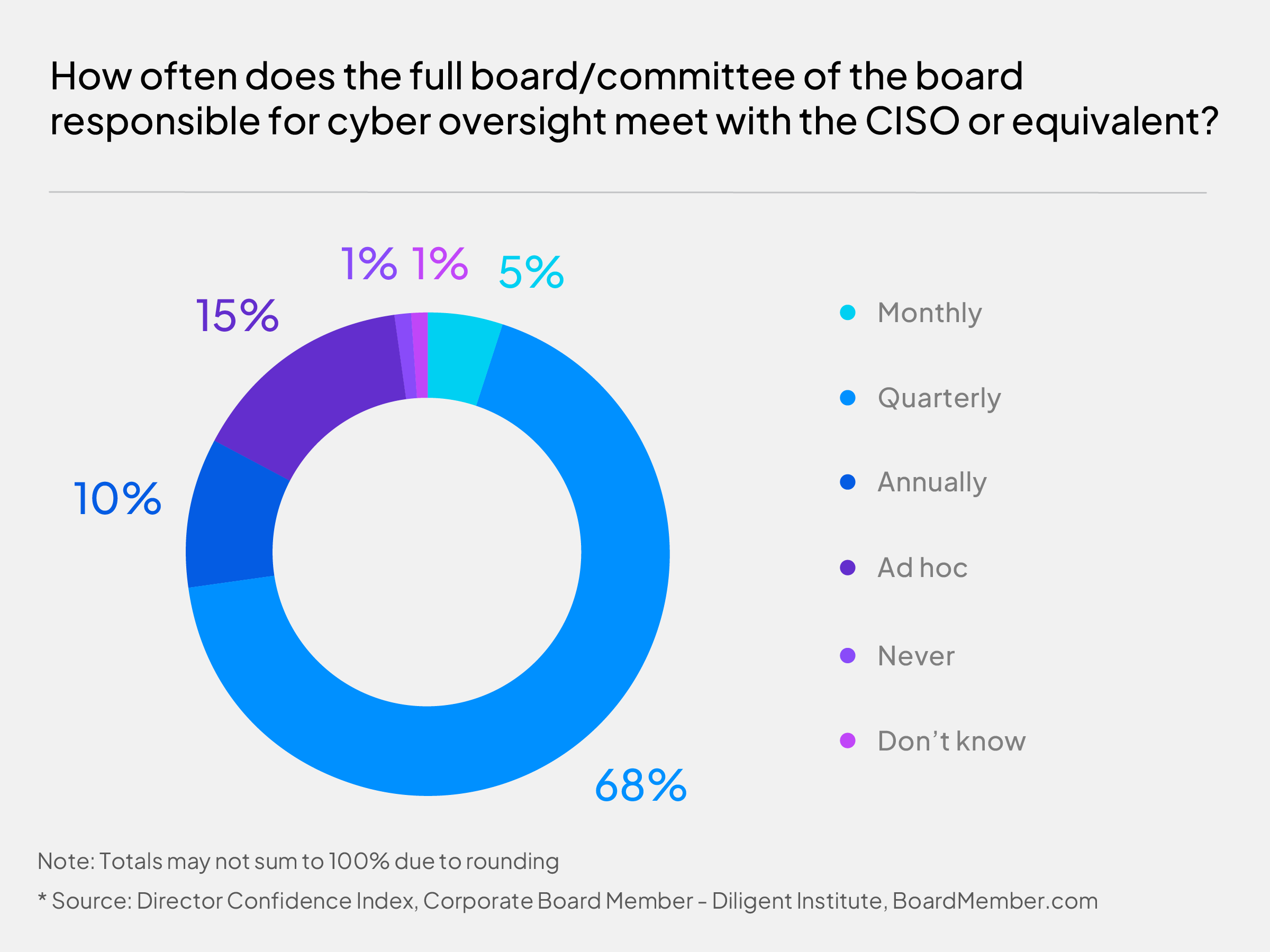

However, boards also report that the committee responsible for cyber oversight receives regular updates from the CISO on cyber strategy. Over two-thirds (68%) indicate that their CISO or equivalent provides quarterly updates.

Quantum computing and the board

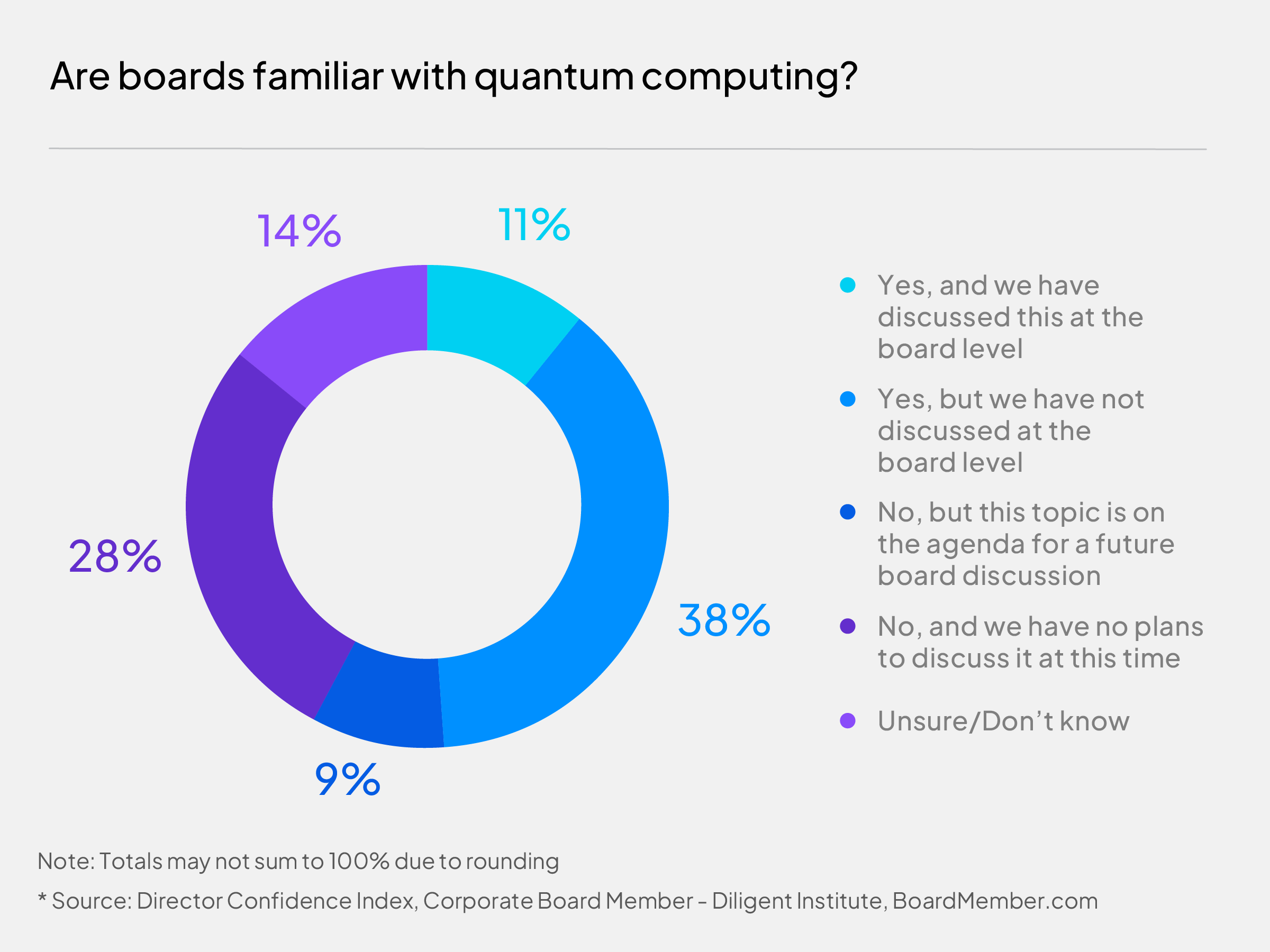

Quantum computing presents significant opportunities for revolutionizing business strategies and enhancing productivity. However, along with these opportunities come substantial risks, When asked about their boards’ familiarity with the concept and its associated risks to business operations, only 11% say their board has discussed this. Another 38% reported being familiar with the term quantum computing but have yet to discuss it in the boardroom. An additional 28% indicated being unfamiliar with quantum computing and have no immediate plans to discuss it.

About the author

Lead Research Specialist

Kira Ciccarelli is the Lead Research Specialist of the Diligent Institute, the modern governance think tank and global research arm of Diligent Corporation. In her role, Kira researches and produces high-level modern governance reports, blog articles and podcasts designed to inform director decision-making and highlight best practices.

Before joining Diligent, Kira worked in a variety of data-driven research roles, including analyzing global aid funds to the UN Sustainable Development Goals (SDGs) and compiling a meta-analysis of political experimental findings for the Analyst Institute. She holds a BA in Public Policy from the College of William & Mary.

Related content

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Inform

What Directors Think 2024

Diligent Institute, Corporate Board Member and BDO surveyed 250 U.S. public company…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – December 2023

After pessimistic forecasts in September and October, the final index of the year finds…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Blogs

Cyber incident risk and the SEC’s cyber reporting regulations

The SEC announced that all public companies must report material cyber incidents within…