Director Confidence Index – December 2023

December 15, 2023

Corporate Board Member

Topics:

Directors split on future business conditions

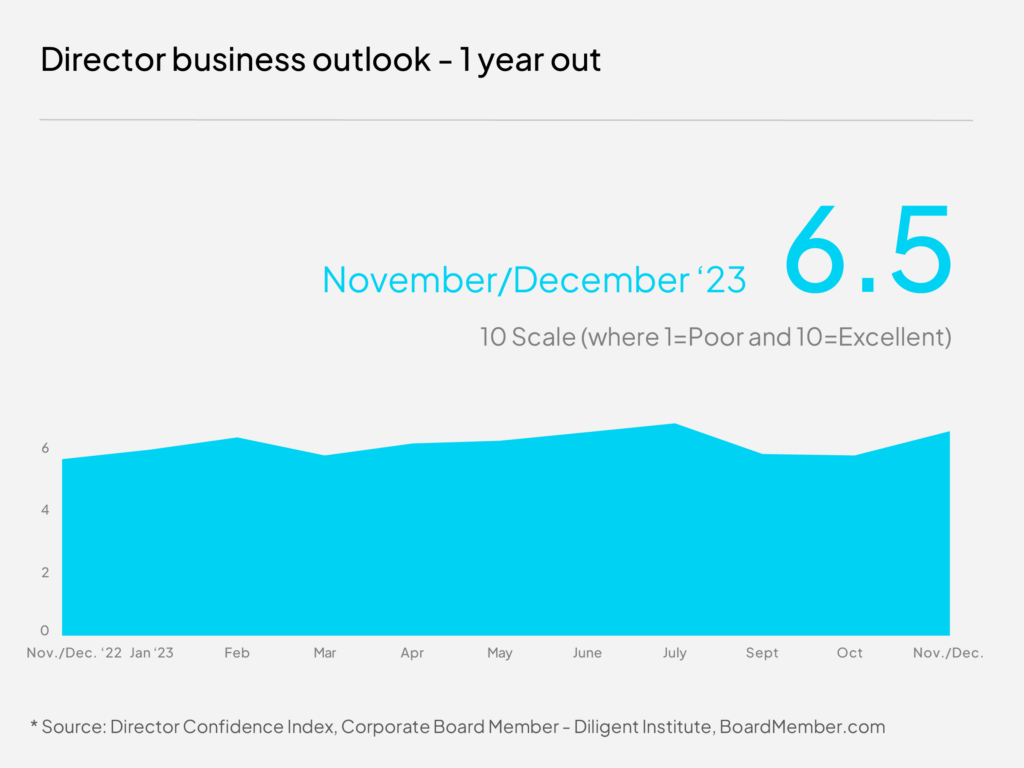

After a fall full of diminishing expectations for 2024, directors polled by Diligent Institute and Corporate Board Member say they are growing more optimistic about business conditions 12 months from now. Their ratings—collected as part of our monthly Director Confidence Index survey, improved substantially in December, with most pointing to expectations and signals of stable interest rates and inflation by year-end 2024. And that was before the Fed’s announcement earlier this week.

Directors’ rating of current business conditions grew 6.6 percent in December, versus the month prior, to 6.4 out of 10—on a 10-point scale where 10=Excellent and 1=Poor, when 123 directors were surveyed on December 3-10. Their rating is the second highest of the year and 9.6 percent higher than their rating last January.

Directors’ outlook follows a similar trend, with the December Index prediction for business conditions 12 months down the line climbing 11 percent from November. Their outlook, now at 6.5 out of 10, matches their outlook from June, before the ups-and-downs of the late summer and fall. This rebound is similar to that of CEOs, whose outlook in December climbed 7.5 percent to 6.3 out of 10, after hitting multi-year lows months prior.

That doesn’t mean there’s agreement, though. Despite the uptick in the index average, dig a bit deeper and you’ll find directors split into even thirds on the question of whether the economy will deteriorate, remain unchanged or improve in 2024.

“The labor market uncertainty and rising costs, coupled with geopolitical uncertainty and U.S. politics including next year’s presidential election, are elements driving my forecast,” says Lenore Sullivan, a corporate director sitting on multiple boards including PotlatchDeltic and RREEF America REIT II. She expects conditions to remain unchanged by December 2024.

Ari Papoulias, corporate director at United Guardian, also forecasts a bit more of the same in 2024. “We are finishing 2023 with high GDP growth, relative strong earnings and signals of ending interest rate hikes,” he says. “Irrespective of how smooth the economic landing is next year, we will go through some volatility to finish 2024 on a high note with some upsides thereafter.”

The third that expects conditions to deteriorate cite U.S. political chaos, global conflict and continued high inflation, including one independent director at a large financials company who told us that “spending will hit an inflection point and slow down at the business and consumer level,” as the reason she expects conditions will deteriorate.

Alan Krusi, independent director at Granite Construction, also expects conditions to deteriorate. Why? “Continued federal government turmoil and likely recession in 2024.”

Still, having a third of directors who expect business conditions to improve is an improvement since last month, when only 29 percent of directors expected conditions would get better versus 44 percent who expected conditions to deteriorate.

Adam Crescenzi, independent chair of the Simply Tuscan Imports board, is among those who, in December, said they expect conditions will improve. He explains: “The Fed will hold interest rates. Expect rates to be lower in a year. Therefore, investments in new products and services will drive growth. Also, selected companies will profit from acquisitions of those companies who did not transform themselves to the new technology competitive environment.”

“Inflation and interest rates are declining. This will bode well for the housing industry,” says Larry Sorsby, independent director at a mid-size consumer discretionary company, to explain why he expects conditions to improve.

The year ahead

When it comes to forecasting for their own businesses in the year ahead, 66 percent of directors now expect increased profitability over the next 12 months, compared to 63 percent of CEOs according to Chief Executive’s latest polling. This was a huge growth in the proportion of positive CEOs since the month prior, when only 47 percent of CEOs projected increases in profits in 2024.

Projections for revenue growth are also buoyant, with 68 percent of directors and 73 percent of CEOs forecasting increases in revenue over the course of 2024. This represented a 30 increase in the proportion of CEOs forecasting revenue growth MoM.

Most directors project either no change or decreasing capital expenditures in 2024—at 65 percent—with only 35 percent projecting increases during that time. Meanwhile, 49 percent of CEOs are planning to increase capex in the 12 months ahead—one of the highest proportions of the year.

Geopolitical risk

While well aware of the potential challenges global conflicts and geopolitical turmoil can present, especially for multinational firms, most directors so far do not seem to be overly concerned about the impact on their companies for 2024-25. In our annual What Directors Think survey, which will be released in January, directors ranked a variety of other issues above the overall geopolitical landscape or the presidential election when it comes to having the greatest influence on their company’s ability to execute on strategic priorities.

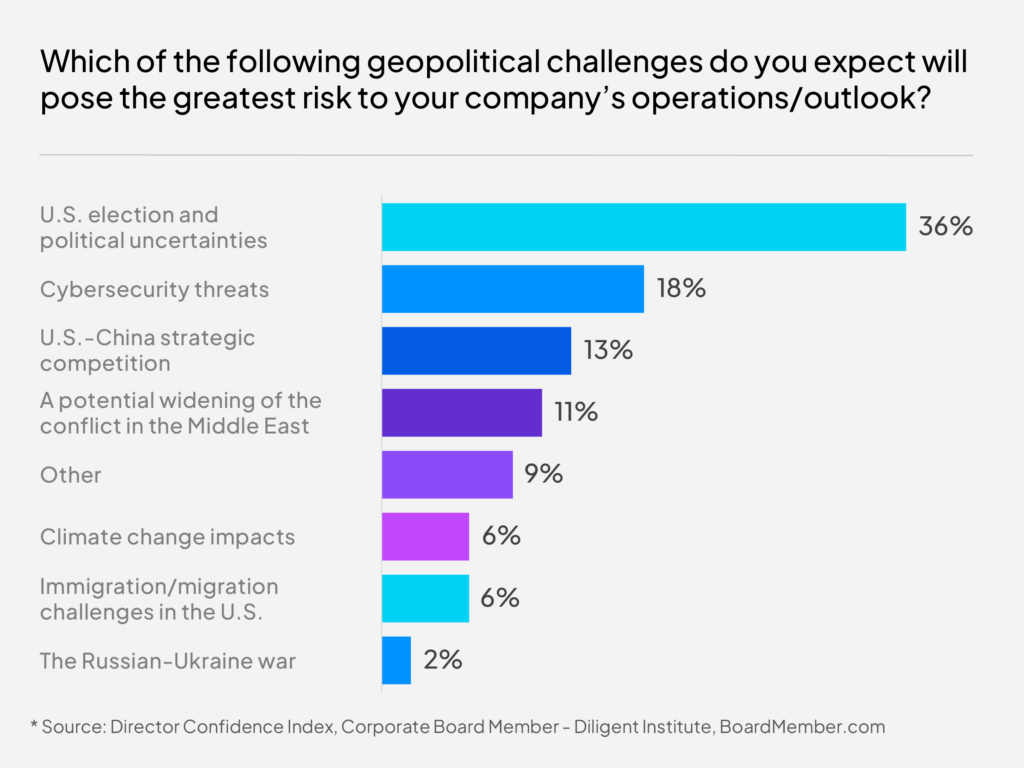

But of the geopolitical risks facing the world right now, the U.S. election poses the greatest risk, directors said in response to questions in our December Director Confidence Index survey. We asked directors to select their top two geopolitical challenges from a list, and 36 percent of directors selected “U.S. election and political uncertainties” as their top risk, making it the most popular response by almost 20 percentage points. Following that is cybersecurity, at 18 percent.

“Politics at federal level and state level is increasingly more incompetent. Unable to make positions in favor of the people. More inclined to focus on partisan politics,” says the director of an upper-mid-sized financials company participating in the survey.

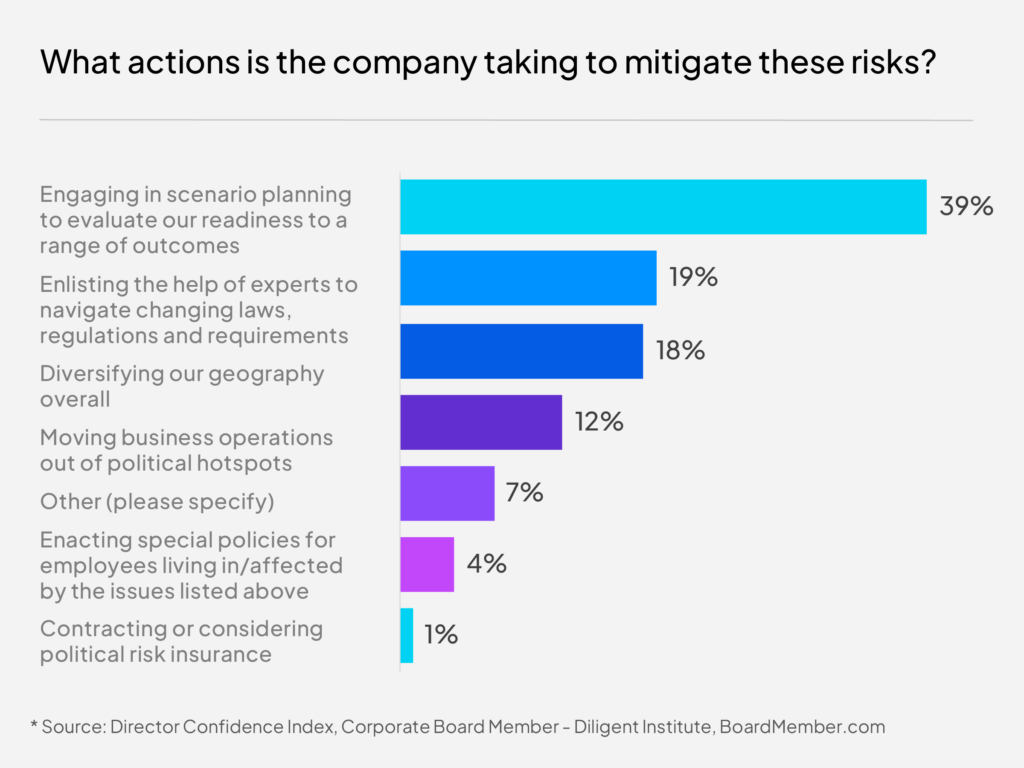

In response to an increased risk environment, 39 percent of directors said they are engaging in scenario planning to evaluate their readiness to a range of outcomes, and 19 percent are enlisting the help of experts to help them navigate changing laws, regulations and requirements.

“Broad uncertainty means boards have to be proactive in discussing impacts under multiple feasible scenarios,” says a participating audit committee member at an upper-mid-sized IT company.

About the author

Related content

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – October 2023

Diligent Institute and Corporate Board Member’s Director Confidence Index for October…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – July 2023

Diligent Institute and Corporate Board Member’s Director Confidence Index for July…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – June 2023

Our June poll of public company board members finds a healthy business environment in the…