Director Optimism Dims in April, as Recovery Forecasts Get Pushed to 2025

Director sentiment in current and future business conditions slipped slightly in April, though an increasing proportion expect improvements post-election.

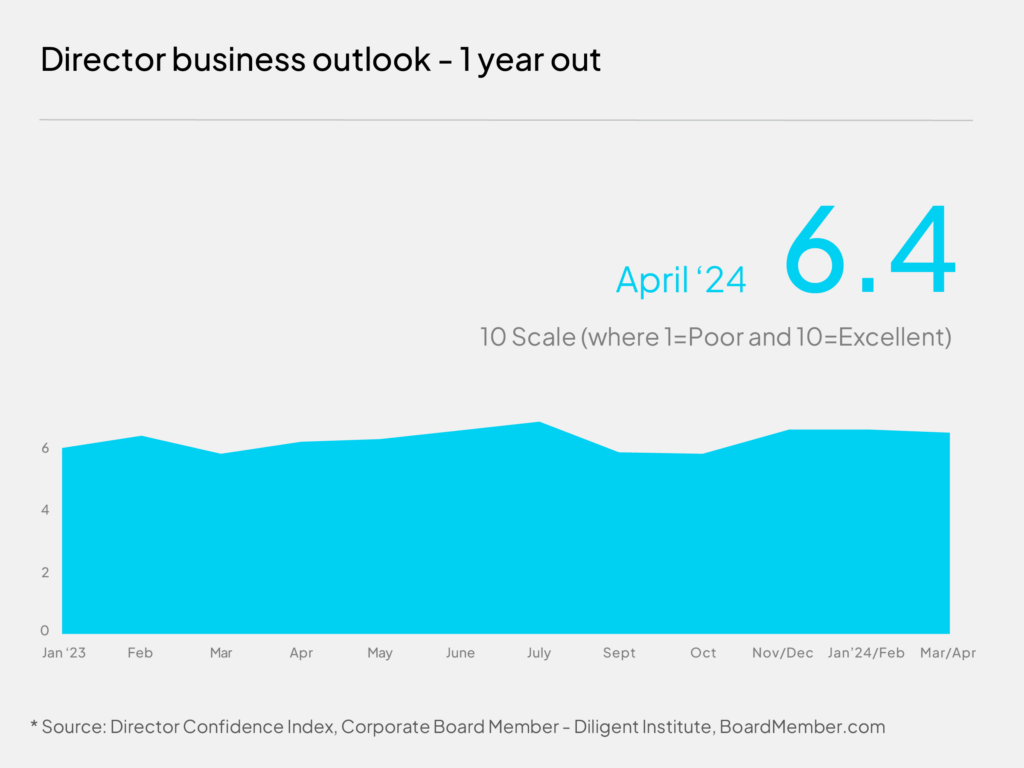

Optimism among public company board members in the U.S. dimmed slightly in April, with forecasts for the business landscape 12 months from now settling at 6.4 out of 10—where 10 is Excellent and 1 is Poor—down from 6.5 the last time we polled them in February.

And when asked to rate current conditions, directors gave the business landscape a rating of 6.1/10, down more than 5 percent from 6.4 in February.

Economic uncertainty and geopolitical conflicts are putting a damper on overall sentiment, according to Corporate Board Member’s bi-monthly Director Confidence Index, conducted in partnership with Diligent Institute, and this is further exacerbated by sticky inflation data, increasing regulations and the threat of new or continued turmoil, here and abroad.

“Global demand is lower than in the last 24 months, and I see no clear change ahead,” said one of the participants in the survey. “U.S. political situation is also not improving, and the risk of more turmoil is high.”

“Inflation and the election are two big unknowns,” said another director. “I expect real inflation to keep rising as the federal government and states keep spending. The election is a crapshoot as both candidates keep promising new programs.”

“There are sources of chaos in too many arenas, creating higher uncertainties—fiscal, regulatory, social, political, global,” said one director, echoing general sentiment among respondents.

Still, the proportion of directors who say they nevertheless expect the U.S. to be past the current set of challenges 12 months from now increased to 43 percent in April, up from 36 percent in our last polling in February. Directors say they expect less volatility—on many levels, from inflation and interest rates to regulations and supply chains—on the other side of the presidential election.

“We don’t seem to have slid into the much-anticipated recession, but this will be an uncertain year in the U.S. due to the presidential election. Once that is behind us, the economy can take stock and begin revving back up,” said Barbara Higgins, an independent director on the board of Employers Holdings.

The year ahead

Surveyed directors say they believe once the Fed begins to lower rates, it will “allow for more investment and research and new product development, the benefit of which will be seen 2 to 3 years from now,” said one participant echoing others.

This outlook may be why 77 percent expect profits to be up by this time next year—and 81 percent forecast increased revenues. Both measures are up from our February polling, from 68 percent and 76 percent, respectively.

Meanwhile, however, most of the directors we surveyed said their companies are pausing capital expenditures, with only 30 percent expecting capex to be higher by this time next year, from 40 percent last February. Instead, the majority (58 percent) say they’re keeping things unchanged on that front for the time being.

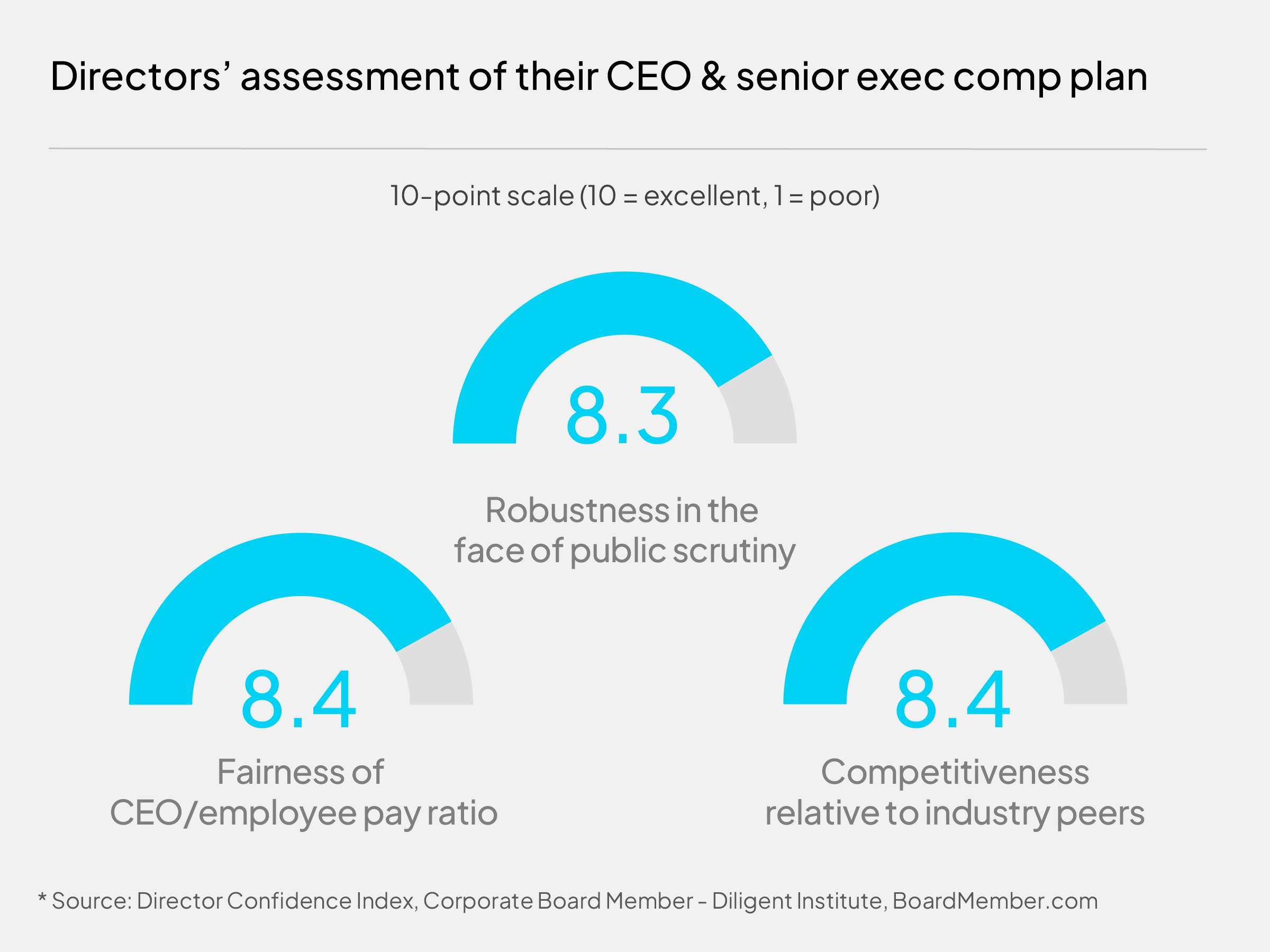

Another area that directors noted isn’t expected to change in the near term is executive compensation. When asked if the board had discussed making adjustments to the CEO and senior executive compensation plan this year, under current conditions and a challenging stock market, the response was an overwhelming no (82 percent).

Perhaps the reason for that is that overall, directors rate their comp plans an 8.4 out of 10 when assessing fairness (CEO/employee pay ratio), competitiveness (relative to industry peers) and 8.3 out of 10 on robustness (in the face of public scrutiny)—though more than a third said they wish they had better industry benchmarking data to support that.